What is Allstate Insurance?

Allstate Insurance Company, founded in 1931, is one of the largest publicly held personal lines insurers in America. Initially established as a part of the Sears, Roebuck & Company, Allstate began offering automobile insurance through direct mail and became a standalone entity in 1993. Over the years, the company has expanded its service offerings and adapted to the evolving needs of consumers, positioning itself as a leader in the insurance industry.

The mission of Allstate is centered around providing quality insurance products and services while promoting safety and security for its clients. This commitment is reflected in the company’s slogan, “You’re in good hands.” Allstate emphasizes building trust with its customers through personalized service, extensive coverage options, and innovative insurance solutions.

Today, Allstate provides a wide range of insurance products tailored to meet the diverse needs of individuals and families. The primary offerings include auto insurance, which covers various vehicles and liability protection; home insurance, designed to protect homeowners against risks such as theft, fire, and natural disasters; and renters insurance, which safeguards personal belongings for those who lease residences. Additionally, Allstate offers life insurance, providing financial security to loved ones in the event of the policyholder’s passing.

Moreover, the company has ventured into additional areas such as motorcycle, boat, and commercial vehicle insurance. Its comprehensive portfolio ensures that customers can find suitable coverage for almost any aspect of their lives. Allstate’s commitment to customer service and innovation positions it as a prominent player in the insurance market, continually striving to adapt and enrich the customer experience.

How to Get an Allstate Insurance Quote

Obtaining an insurance quote from Allstate is a streamlined process that can be completed in various ways, each designed to cater to the preferences of the customer. To begin, individuals should gather the necessary information which is crucial for an accurate quote. This typically includes personal details such as name, address, date of birth, and contact information, as well as specific data pertaining to the assets that require coverage, like vehicle identification numbers or home specifications.

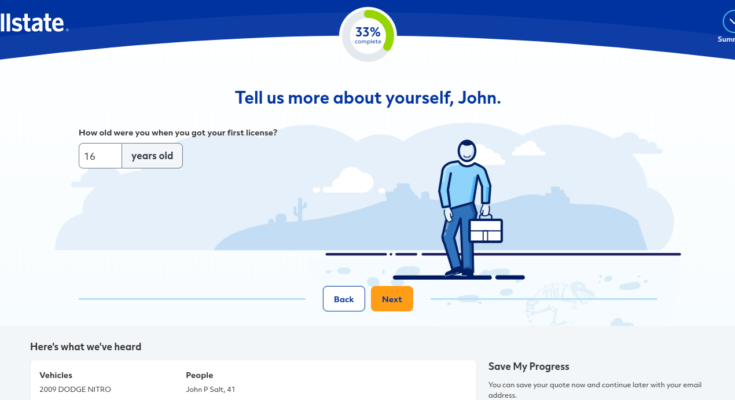

Once the necessary details have been compiled, potential customers can obtain their Allstate insurance quote through several methods. The first option is to visit the Allstate website. This online platform is user-friendly and guides individuals through a series of prompts where they can input their gathered information. After completing the required fields, users can quickly receive an estimate tailored to their specifications. Alternatively, individuals may prefer to engage directly with an Allstate agent over the phone; this method allows for a more personalized approach, where agents can answer specific questions and provide assistance in real-time.

For those who value face-to-face interactions, visiting a local Allstate office is another effective method. Meeting with an agent in person can foster a better understanding of coverage options and clarify any uncertainties regarding the process. It is essential to note that the quotes received may vary depending on multiple factors, such as the applicant’s driving history, credit score, and the type of coverage selected. Therefore, it is imperative for individuals to provide accurate and complete information when seeking a quote, as discrepancies can lead to adjustments in the final quote amount. This diligence ensures that customers receive a fair evaluation of their insurance needs and potential costs associated with coverage.

Factors Influencing Your Allstate Insurance Quote

Several key factors contribute to determining your Allstate insurance quote, affecting both the total cost and the level of coverage. Personal demographics are among the first elements considered. Factors such as age, marital status, and credit score play a significant role in the underwriting process. Generally, younger individuals may face higher premiums due to perceived inexperience or higher risk profiles. Conversely, established adults who have maintained good credit histories often benefit from lower rates.

The type of insurance required is another critical factor impacting your Allstate insurance quote. Whether you are seeking auto, home, or life insurance, each category has its own set of risk assessments. For instance, a comprehensive auto policy might come with different pricing structures compared to a basic liability plan. Furthermore, specific types of coverage within each category, like collision or personal injury protection in auto insurance, can elevate the total cost.

Your geographic location is also influential in shaping your Allstate insurance quote. Areas with higher crime rates or frequent natural disasters typically lead to increased premiums, as they signify a higher risk level. Conversely, residing in a low-crime area or one that is less prone to disasters can result in lower quotes. Coverage limits and deductibles significantly affect insurance pricing as well. Opting for a higher deductible might lower your premium but could increase out-of-pocket expenses during a claim. Allstate evaluates these factors to determine associated risks and applies them to your specific situation.

By understanding these various elements and how Allstate assesses risk, individuals can make informed decisions and potentially lower their insurance quotes. This can include improving credit scores, choosing appropriate coverage levels, and assessing geographic risks in their locales.

Understanding and Comparing Allstate Quotes

When exploring Allstate insurance quotes, it is essential to grasp the various components that constitute each quote. The insurance landscape can be riddled with jargon, making it challenging for consumers to decipher what is being offered. Key terms you will encounter include “premiums,” which refer to the amount you pay for your insurance policy; “deductibles,” which are the out-of-pocket expenses you must incur before your insurance kicks in; and “coverage options,” which outline the specific protections included in your policy.

To effectively compare Allstate quotes with those from other insurance providers, understanding these terms is paramount. For instance, a lower premium might seem appealing, but it could be misleading if coupled with a high deductible or inadequate coverage options. A comprehensive evaluation should not be limited to price alone. Instead, assess the overall value the policy offers in terms of the protections it provides and your specific needs.

While considering quotes from Allstate and competitors, take note of the coverage limits. These limits dictate how much the insurer will pay for a claim, thus directly impacting your financial protection. Additionally, examine potential endorsements or riders that might enhance your coverage, such as personal property protection or roadside assistance. These add-ons can significantly affect the reliability of your policy.

Finally, a prudent strategy is to make use of online comparison tools. Such resources allow you to view multiple quotes side by side, enabling a clearer assessment of not just the costs, but the breadth of coverage each insurance policy offers. By prioritizing comprehensive coverage and understanding the terminology involved, you can make informed decisions to secure the best insurance policy suited to your requirements. In summary, focus on value and coverage to navigate the insurance landscape effectively.